The Best Accounting Software For Small Businesses in 2024

Managing finances is one of the most critical aspects of running a successful small business. With the right accounting software, you can streamline bookkeeping, automate invoicing, manage cash flow, and ensure tax compliance with ease. For small business owners, choosing the best accounting software can significantly impact both daily operations and long-term financial health.

In this article, we’ll explore the best accounting software solutions available in 2024, their features, pricing, and the benefits they bring to your business. Whether you’re a freelancer or running a growing company, finding the right accounting tool can simplify financial management and save you time and money.

Why Choosing the Right Accounting Software Is Important for Small Businesses

Selecting the right accounting software is essential for small businesses due to the direct impact it has on efficiency, financial accuracy, compliance, and growth potential. Unlike larger organizations, small businesses often operate with limited resources, and the right accounting solution can help them manage finances with greater control, efficiency, and scalability. Here are the key reasons why choosing the right accounting software is crucial for small businesses:

1. Improves Financial Accuracy and Reduces Human Error

Manual accounting processes, such as entering data, creating invoices, or calculating taxes, are prone to human error. Even minor mistakes in bookkeeping can lead to serious consequences, from inaccurate financial reporting to costly IRS penalties. Accounting software automates many of these processes, ensuring accuracy in financial records by reducing the risk of manual errors.

- Automated Calculations: Accounting software automatically performs calculations for expenses, revenue, taxes, and payroll, ensuring precision without the need for repetitive manual input. This significantly reduces the likelihood of errors in bookkeeping, leading to more accurate financial data.

- Error Detection: Many accounting tools include features that detect anomalies, such as duplicate entries or mismatched accounts, alerting users to potential issues before they impact financial reports.

For example, if a business owner accidentally enters the same expense twice, software like QuickBooks or Xero can flag this as a duplicate entry, prompting the user to review the transaction. By catching and correcting these errors early, the business can maintain a more accurate and reliable record of financial data.

2. Enhances Financial Decision-Making

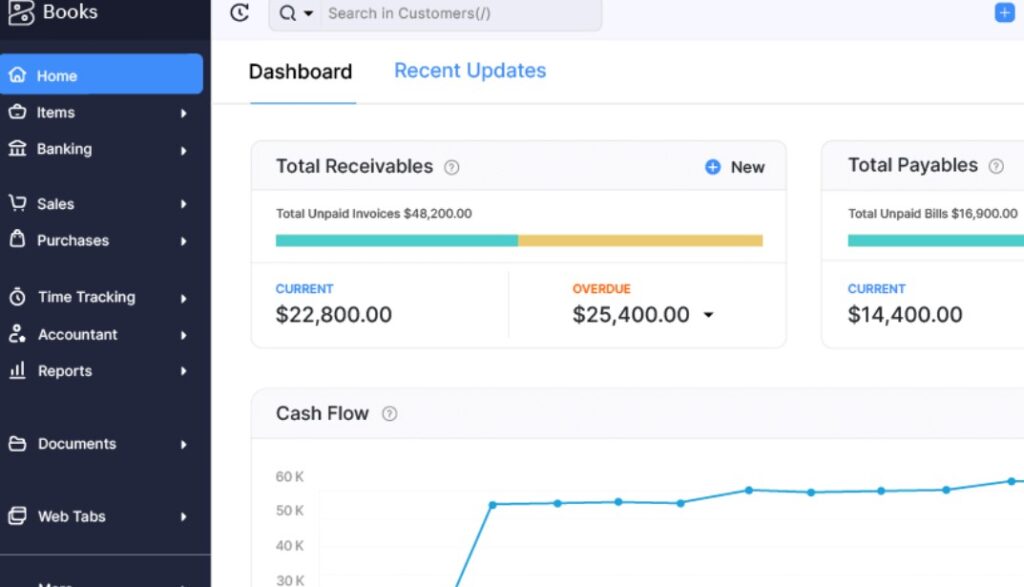

Accurate, up-to-date financial information is essential for making informed business decisions. The right accounting software provides real-time insights into a business’s financial health, offering access to cash flow, expenses, and revenue trends in one place. This data helps business owners make strategic decisions about budgeting, investment, and growth.

- Real-Time Reporting: Many accounting solutions offer dashboards and reports that show key performance metrics like profit margins, outstanding invoices, and monthly revenue. By having a clear view of financial data, business owners can make timely decisions to manage cash flow, cut unnecessary costs, or reinvest in the business.

- Forecasting Tools: Advanced accounting software includes forecasting and budgeting tools, enabling small businesses to predict future revenue, expenses, and cash flow based on historical data. This helps business owners prepare for potential financial challenges and make proactive adjustments to business strategies.

For example, if a business experiences seasonal fluctuations in revenue, accounting software with forecasting capabilities can help the owner plan for these changes, ensuring they have enough cash reserves to handle slower periods. This proactive approach to financial management minimizes risk and prepares the business for growth.

3. Saves Time Through Automation

Time is a valuable resource, especially for small business owners who often manage multiple aspects of their business. Accounting software automates repetitive tasks like invoicing, expense categorization, and payroll, allowing business owners to focus on core activities instead of getting bogged down in manual bookkeeping.

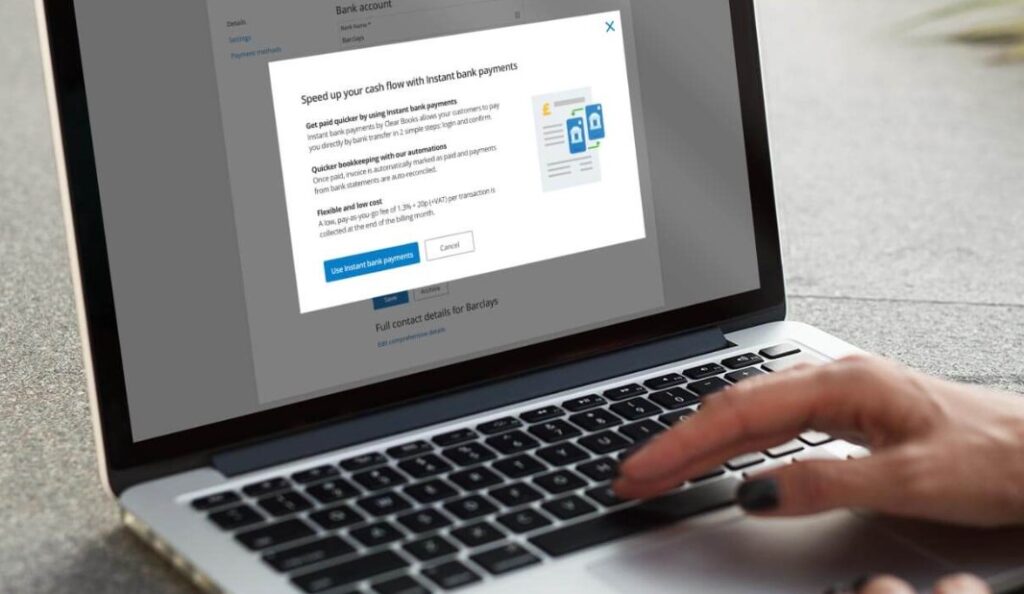

- Automated Invoicing and Payments: Many accounting platforms automatically generate and send invoices, apply late fees, and reconcile payments. This ensures timely cash flow without requiring constant manual follow-up on outstanding payments.

- Expense Tracking and Categorization: Accounting software can automatically import and categorize expenses, allowing business owners to view and organize transactions with ease. This streamlines expense management and ensures accurate records come tax season.

For instance, using an accounting tool like FreshBooks enables a small business owner to set up recurring invoices for clients with regular payments. The software handles invoicing automatically, reducing the need for manual intervention, improving cash flow, and freeing up time that can be better spent on business development.

4. Simplifies Tax Preparation and Compliance

Preparing for tax season can be daunting, especially for small businesses that lack dedicated accounting staff. The right accounting software simplifies tax preparation by organizing financial records, categorizing expenses, and generating tax-compliant reports. By streamlining tax-related tasks, accounting software ensures that small businesses meet compliance requirements and avoid penalties.

- Automated Tax Calculations: Many accounting tools automatically calculate taxes on income, sales, and payroll, reducing the complexity of tax filing. These calculations are based on the latest tax regulations, ensuring that businesses comply with federal, state, and local tax laws.

- Audit-Ready Reports: Accounting software generates detailed reports for income, expenses, deductions, and other tax-related categories. These reports provide an accurate record of financial activities, making it easier to file taxes and respond to potential audits.

For example, a business using Xero can generate year-end financial reports with just a few clicks. These reports categorize expenses and deductions, providing a clear summary for tax filing. If the IRS requests documentation, the business owner can easily retrieve accurate, organized reports, reducing the stress and time involved in an audit.

5. Enhances Cash Flow Management

Cash flow is the lifeblood of any business, and managing it effectively is essential for small business survival. Accounting software offers tools for tracking incoming and outgoing payments, helping business owners maintain healthy cash flow and avoid shortfalls.

- Real-Time Cash Flow Monitoring: Accounting platforms provide a real-time overview of cash flow, showing money coming in from customers and going out for expenses. This helps business owners identify potential cash flow issues and take action, such as cutting unnecessary expenses or securing additional funding.

- Automated Payment Reminders: Many accounting tools send automatic reminders for unpaid invoices, encouraging timely payments from customers. By improving accounts receivable, businesses can maintain steady cash flow and avoid the challenges that come with late payments.

For instance, QuickBooks offers cash flow forecasting, which allows business owners to predict when they might experience cash flow shortages. This gives them the opportunity to plan accordingly, ensuring they have enough funds to cover essential expenses like payroll and inventory.

The Best Accounting Software for Small Businesses

1. QuickBooks Online

Overview:

QuickBooks Online is one of the most widely-used accounting software solutions for small businesses. Known for its robust features, ease of use, and flexibility, it caters to businesses of all sizes, from freelancers to mid-sized companies. QuickBooks Online integrates seamlessly with hundreds of third-party apps, making it highly adaptable to various business needs.

Key Features:

- Automated invoicing, expense tracking, and payroll

- Real-time dashboards with customizable reports

- Mobile app for accounting on the go

- Integration with over 600 business apps, including PayPal, Shopify, and Square

Pros:

- User-friendly interface with extensive support

- Scalable for growing businesses

- Comprehensive tax and reporting tools

Cons:

- Pricing may be high for very small businesses

- Learning curve for more advanced features

Price:

QuickBooks Online offers multiple pricing tiers, starting at $30/month for the Simple Start plan, which includes basic features. More advanced plans (Essentials and Plus) offer additional features, like bill management and time tracking, for $55/month and $85/month, respectively.

Use Case:

QuickBooks Online is ideal for small business owners who need a versatile and scalable solution that can grow with their business. It’s particularly useful for businesses that require integration with other apps and tools for invoicing, payroll, and reporting.

Where to Buy:

Buy QuickBooks Online directly from their official website, where you can choose a pricing plan that best fits your business needs.

2. Xero

Overview:

Xero is a cloud-based accounting software solution that caters to small and medium-sized businesses. It offers a range of powerful features, including real-time bank reconciliation, expense tracking, invoicing, and payroll management. Xero’s intuitive design and clean interface make it a top choice for businesses looking for an easy-to-use yet feature-rich accounting platform.

Key Features:

- Automatic bank and credit card reconciliation

- Unlimited users for all plans

- Invoicing, expense tracking, and inventory management

- Integration with over 1,000 third-party apps

Pros:

- Excellent customer support

- Real-time updates on cash flow and financial performance

- Scalable for businesses of all sizes

Cons:

- Limited phone support

- Higher learning curve for users unfamiliar with accounting software

Price:

Xero pricing starts at $13/month for the Early plan, which includes basic features. The Growing plan is priced at $37/month and includes unlimited invoicing and bills, while the Established plan costs $70/month and adds features like multi-currency support and expense management.

Use Case:

Xero is best suited for small businesses looking for a cloud-based solution that provides flexibility and integrates seamlessly with other business apps. It’s particularly beneficial for businesses with multiple users, as Xero allows unlimited users for all its plans.

Where to Buy:

Purchase Xero directly from their website, where you can sign up for a free trial before committing to a plan.

3. FreshBooks

Overview:

FreshBooks is a popular accounting software solution for freelancers, self-employed professionals, and small business owners who want to simplify their financial management. With a focus on invoicing and expense tracking, FreshBooks offers intuitive tools that make managing your business finances easy.

Key Features:

- Simple invoicing and payment processing

- Time tracking and project management tools

- Automated expense tracking

- Multi-currency support

Pros:

- Extremely user-friendly and easy to set up

- Tailored for freelancers and small businesses

- Excellent customer support

Cons:

- Limited advanced accounting features

- Higher pricing for businesses with multiple clients

Price:

FreshBooks offers tiered pricing starting at $17/month for the Lite plan, which includes invoicing and expense tracking for up to five clients. The Plus plan costs $30/month and supports up to 50 clients, while the Premium plan costs $55/month for unlimited clients.

Use Case:

FreshBooks is ideal for freelancers and small business owners who prioritize invoicing, project management, and payment processing. It’s a great option for those who want a simple, easy-to-use accounting solution with excellent support.

Where to Buy:

Get FreshBooks on their website, where you can explore different pricing plans and sign up for a free 30-day trial.

4. Zoho Books

Overview:

Zoho Books is part of the larger Zoho ecosystem and offers a robust set of accounting tools for small and medium-sized businesses. With features like automated workflows, advanced inventory management, and real-time collaboration, Zoho Books is an excellent choice for businesses looking for a cost-effective, all-in-one accounting solution.

Key Features:

- End-to-end accounting automation

- Detailed financial reports and analytics

- Automated recurring invoices and payment reminders

- Integration with over 40 business apps in the Zoho suite

Pros:

- Cost-effective with a free version available for businesses with revenue under $50,000

- Seamless integration with other Zoho applications

- Customizable dashboards and reports

Cons:

- Limited third-party integrations outside the Zoho ecosystem

- Fewer advanced features compared to competitors like QuickBooks

Price:

Zoho Books offers affordable pricing, starting at $15/month for the Basic plan. The Standard plan costs $50/month, while the Professional plan is priced at $70/month, with advanced features like purchase orders and sales orders.

Use Case:

Zoho Books is perfect for small businesses already using other Zoho apps, as it integrates seamlessly within the ecosystem. It’s also a good fit for businesses looking for a budget-friendly accounting solution without compromising on essential features.

Where to Buy:

Purchase Zoho Books from their website, where you can also explore their free plan for businesses with minimal revenue.

5. Wave Accounting

Overview:

Wave is a free accounting software solution designed for freelancers, self-employed professionals, and small business owners who need basic accounting features without the cost. Wave provides tools for invoicing, expense tracking, and reporting, making it a great option for businesses with limited accounting needs.

Key Features:

- Free invoicing, expense tracking, and reporting

- Direct integration with payment processors

- Simple dashboard for managing cash flow

- Tax preparation tools and automated reminders

Pros:

- Completely free for core features

- Easy to use, especially for non-accountants

- No hidden fees or surprise charges

Cons:

- Limited features compared to paid solutions

- Customer support can be slow

Price:

Wave’s core accounting features are entirely free. However, if you choose to use Wave’s payroll service or credit card processing, additional fees apply (starting at $20/month for payroll services).

Use Case:

Wave is perfect for freelancers, contractors, or small business owners who need a simple, cost-effective accounting solution. It’s ideal for businesses with limited financial needs that don’t require advanced features like inventory management or time tracking.

Where to Buy:

Sign up for Wave directly on their website for free access to their core accounting features.

Benefits of Using Accounting Software for Small Businesses

Implementing accounting software offers numerous benefits for small business owners, including:

- Automation: Accounting software automates repetitive tasks like invoicing, payroll, and expense tracking, saving valuable time and reducing the risk of human error.

- Accurate Financial Records: By using accounting software, businesses can maintain accurate and organized financial records, making it easier to file taxes and stay compliant with regulations.

- Real-Time Financial Insights: Accounting tools offer real-time reporting, helping business owners make informed decisions based on up-to-date financial data.

FAQs

1. What is the best accounting software for small businesses in 2024?

QuickBooks Online, Xero, and FreshBooks are among the top choices, offering a range of features to suit different business needs, from invoicing to payroll and tax management.

2. Can I find free accounting software for small businesses?

Yes, Wave Accounting offers a free version with essential accounting features like invoicing, expense tracking, and reporting.

3. What features should I look for in accounting software?

Look for features like automated invoicing, real-time reporting, integration with other business apps, and scalability as your business grows.

By choosing the right accounting software, small businesses can streamline their financial management, improve accuracy, and save time on administrative tasks. With options ranging from free software like Wave to advanced solutions like QuickBooks Online, there’s a tool for every type of small business in 2024.